Businesses are not typically comfortable toying with risk. Most of the time, the higher the risk, the less desirable merchants are, especially when it comes to processing payments. However, high-risk comes with benefits that might be of interest to companies, especially if global expansion is on the list.

What Is a High-Risk Merchant Account?

Before accepting merchant accounts, there’s a long list of things to check out. If it turns out that a business is prone to chargebacks and fraudulent claims, they are considered high-risk. When a merchant account is labeled risky, companies can expect to pay higher fees for merchant services or a rolling reserve that will cover any mishaps due to faulty transactions. Typical characteristics of a high-risk merchant include:

- Transactions between countries with prevalent fraud

- A long history of chargebacks

- Monthly sales of $20,000 or more

- Average credit card purchases of $500+

Industries with High-Risk Merchant Accounts

Industries known for high levels of chargebacks and refunds are considered high-risk; for example, the gambling industry. Money is passed back and forth between thousands to millions of accounts daily. Due to the high-risk nature of the game, consumers are likely to cancel or request funds back after being charged. All the action leads banks to add extra fees, unable to predict what will happen with each new day. Other types of high-risk accounts include the travel industry and stock trading.

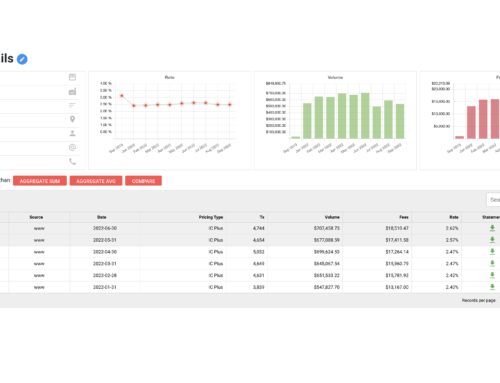

Fees That Match Risk

High-risk merchant accounts come with more costs to manage. High fees for high risk are nothing new. However, in recent years, payment processors have released competitive rates to appeal to high-risk businesses. These days, there are more safety measures in place that protect companies from taking hits with high-risk accounts, with banks more apt to work with them, not against them.

Pros and Cons of Accepting High-Risk Merchant Accounts

It’s a common rule of thumb to stay away from risks as a business. However, that’s changing with help from new industry standards for high-risk accounts. Though risk gets a bad rep, there are potential gains to accepting high-risk merchant accounts.

The Pros

Bump Up Earnings

There are no revenue limits to high-risk business accounts, which could mean higher earning potentials for businesses.

Sell Anything

As long as someone is buying it, there are no limitations on what you can sell.

Zero Boundaries

High-risk merchant accounts are borderless, making global expansion a possibility.

The Cons

Chargebacks

Because they are common when dealing with high-risk businesses, expect to pay higher fees for every chargeback.

Money in Reserve

As a precaution, most banks require high-risk accounts to have reserved funds on hand to pay for additional fees from chargebacks and refunds.

Don’t Run Away from High Risk

In business, taking risks is not always a bad thing. When it comes to merchant accounts, accepting them could be a profitable option if dealing with a secure payment processor that won’t overwhelm them with fees. Instead of running from high-risk merchant accounts, adapt; with evolved merchant solutions that secure high-risk.