Tips on how to pick the best merchant account provider for a business based on individual conditions

How to Choose a Merchant Account Provider

If you’re trying to tap into a growing market, you can’t overlook Millennials. And if you want to attract Millennials to your business, you better accept credit cards.

Millennials more than all other generations turn to credit first. A recent NPR/Marist poll found roughly 63 percent of Millennials say they use credit cards for their purchases.

Digital transactions may bring peace of mind to Millennials but to merchants and small business owners, credit cards can be expensive and tedious.

Here are some tips on how to choose a merchant account provider, lower your business costs and attract Millennials.

What is a Merchant Account Provider?

A merchant account provider may sound like a confusing industry term but it is important to understand it in order to maximize profits. In simple terms, a merchant account provider supplies owners with money from customer transactions immediately.

These are convenient for business as you don’t have to wait a month for the customer to pay their bill; your business gets paid immediately.

Most of the time, merchant account providers’ services are centered around connecting payment from buyer to seller. Many providers offer additional services to help businesses like inventory management and employee tracking.

The downside to merchant account providers is that they take a portion of the credit card transaction they’re handling. Sometimes, they charge additional fees that decrease potential earnings. Also, some providers may be sneaky and throw in extra fees that you didn’t sign up for.

Different Types of Merchant Account Providers

There are different types of merchant account providers, that vary by the business. When choosing a merchant provider, it’s easier to compare and contrast providers based on what they charge.

There are three types of price models that providers can charge and they can impact your potential earnings in different ways.

- Flat Rate: This fee is self-explanatory. The flat rate method can work in three different ways such as a standard fee per purchase, a percent of each transaction, and a combination of the aforementioned examples. Subscription based models can fall under this category as businesses pay one set fee like $100 per month to have a provider service. Flat rate fees are the easiest to understand due to its consistent nature. Small businesses may choose this model as it’s easy to track and plan costs. Flat rate fee models are the best for start-ups.

- Interchange-plus transaction fees: Essentially, this model provides transparency because it separates the fees. The first fee is the price that the credit cards charge to handle the transaction (the interchange). The second fee is a markup and directed to the provider. More often than not, the markup appears to be a combination of a percentage and a flat fee. An example of this can be a fee of 0.5% + $0.05.

- Tiered pricing: This model bundles all different cost categories into tiers, based on the provider’s perceived risk level of the merchant and the transactions they conduct. Most small businesses should steer clear of providers who use this price model as it would be difficult to determine the actual cost. Fees can add up due to the unclear nature of this model.

What Merchant Account Provider is Right for You?

When choosing your provider, here are some questions to ask depending on your business’ needs.

- Do they provide other services to help you manage your business?

- Is tech support available if necessary?

- If the provider allows your customers to pay in a variety of methods like mobile or online?

Also, businesses should calculate their average monthly costs to determine whether a subscription model will be the most cost effective. Larger businesses that perform a lot of transactions should probably get a monthly subscription as its one set cost.

Start-up businesses or those that may be perceived as “risky enterprises” should probably use a flat rate model. This is so they don’t have to worry about making a set amount of sales– they can pay as they go.

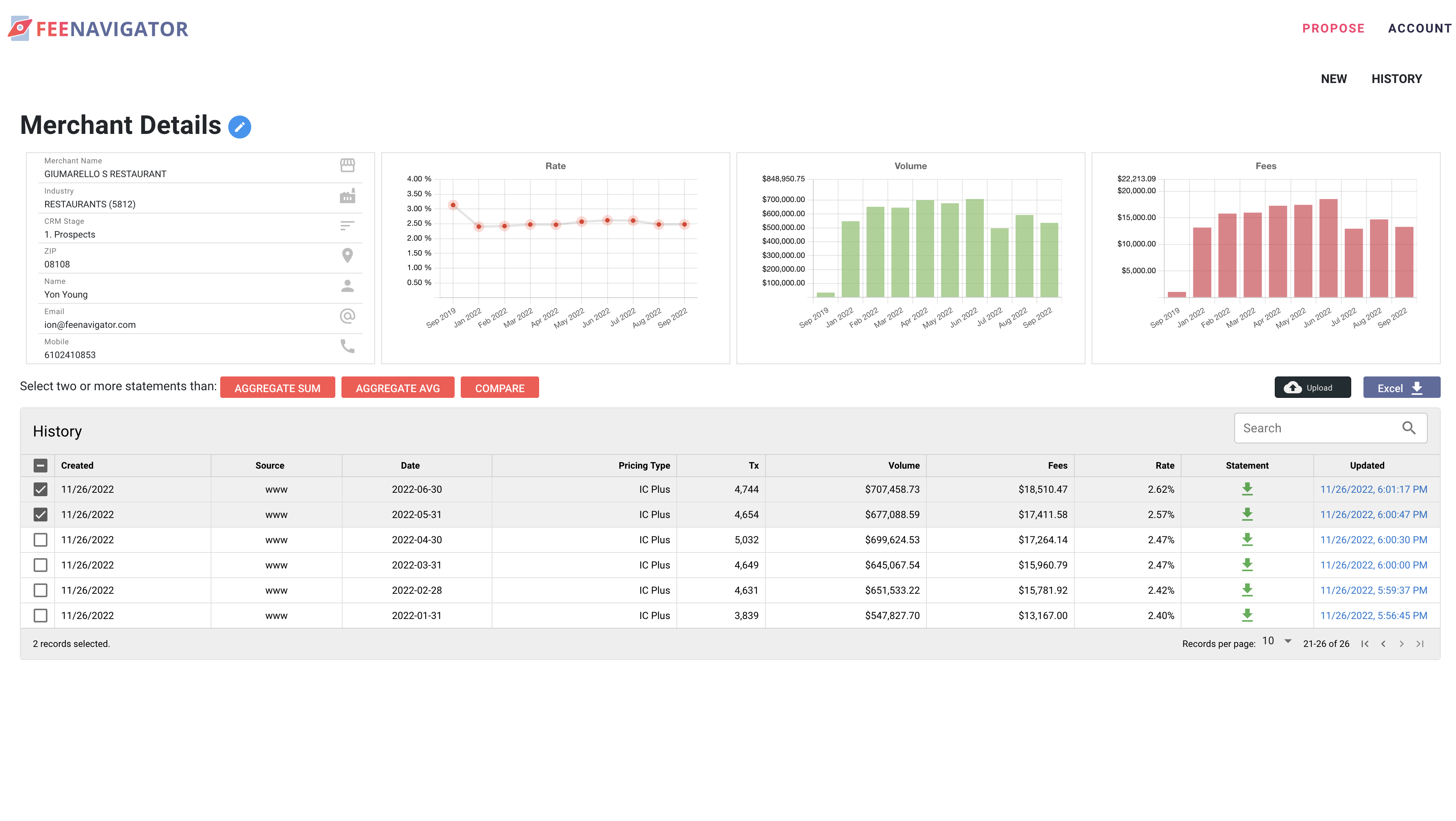

Need more help deciding which merchant service provider you should choose?

Fee Navigator is a service that uses AI to analyze merchant statements. Using their technology, they thoroughly assess what merchant service provider is most cost-effective for your business. This company’s flexible pricing allows businesses of any size to use this service and avoid further confusion.