The world of business is international. Companies can no longer rely on domestic growth.

If your business has expanded into international markets, there is a good chance you need a different kind of merchant provider to process your international transactions.

This blog will help you better understand the benefits of international merchant accounts and how to find the best provider for your business.

What is the difference between Domestic Merchant Accounts and International Merchant Accounts?

Both domestic merchant accounts and international merchant accounts are account services used to process multiple payments from customers. International accounts accept and process payments in different currencies and transfer the amount to your desired currency.

When looking for an international merchant account provider be clear about the needs and wants of your business. Here are some tips to help you find a provider that best fits your business model.

- Variety of Currencies. The provider should be able to transfer the currency your customer paid with into the currency that you desire. In simple terms, look for a provider that has a wide variety of currencies available.

- Quick and Easy Processing in Multiple Currencies. Customers just want to swap their credit card. They don’t want to think about the conversion process. Make sure your international merchant provider is quick and efficient for the customer.

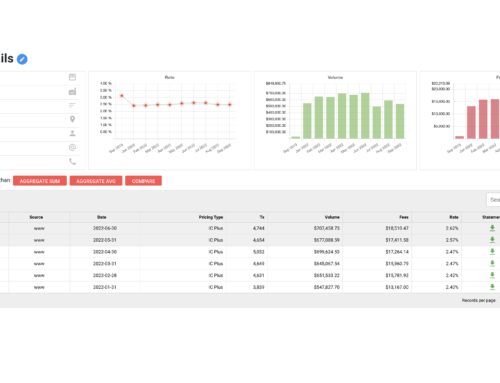

- Research Merchant Rates. Not all international merchant transaction fees are the same. It’s important to research the merchant rate your process provider charges. These little fees can quickly add up.

Benefits of International Merchant Accounts

International merchant accounts can help businesses that deal with customers abroad by accepting a range of different payment options. Here’s a closer look at how they can benefit international businesses.

- International merchant accounts help businesses better connect with clients, regardless of the country.

- Customers can pay in their own currency, rather than having to exchange for a foreign currency.

- International merchant accounts can help you with local taxes since they understand the local market and laws better than domestic merchant accounts.

- International merchant accounts can provide new networking opportunities in different markets.

- Customers want to pay in their local currency, so by using an international merchant account, your improving the customer service relationship.