In 2021, consumers have become accustomed to AI-powered systems – Siri, Alexa, and social media algorithms are all examples of how artificial intelligence is leaving its imprint on our daily activities. Ever notice how after you Google something like “How to lose weight fast,” your social media feeds become curiously peppered with advertisements for weight loss shakes and local gym memberships?

That’s because the power of AI, often using bits and pieces of human logic, can far outstrip humans when it comes to speed and accuracy – something that marketing, technology, and finance industries have been capitalizing on for a while now. Since Fee Navigator’s inception, we’ve been training our AI to become better, faster, and more intuitive. Now, we’ve taken a giant leap forward in the level of automation and efficiency we can offer our clients.

Here’s how it works.

Over the past two years, we’ve fed our AI a massive amount of information, including our own tagging and labelling. We’ve trained it to discern from a variety of merchant statement types, as well as to identify interchange terms, dues and assessments, and processor-specific fees. We’ve also trained it to differentiate amongst various pricing types.

Then, we’ve wrapped this technology into the simplest, most intuitive interface we could think of, to make going from a merchant statement to a custom branded proposal in seconds, with no data entry. The result? When you drop a statement in Fee Navigator, a few new things happen, almost like magic:

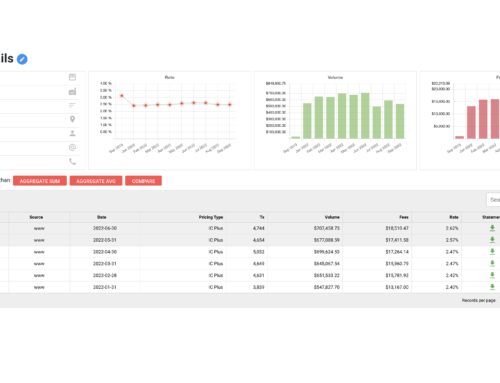

- The PDF statement is converted into its textual representation, regardless of whether it is native, or we may need to run optical character recognition (OCR) processes

- The text quality is semantically reviewed and enhanced (especially if it’s OCR’d)

- AI identifies statement type, pricing, interchange, dues and assessments, and processor-specific fees

- The system applies your pre-defined pricing, commissions, and document templates, then presents an on-screen summary highlighting profitability and residuals, with Excel, Word, and PDF exports

- Your expert users may go outside the pre-defined pricing and set their own margin targets, with the system crunching the numbers based on the required margin

When you purchased your latest iPhone, it didn’t come with a printed instruction manual. Why? There’s a myriad of reasons why Apple might have chosen to forgo this little packet, but here’s the important thing: With the advances in today’s technology, you probably didn’t need it anyway. You simply pick it up and use it – it adapts to you, and you to it.

The newest version of Fee Navigator aims for that same level of accessibility. Our user-friendly interface and set-it-and-forget-it plans and pricing structures make the analysis processes inherent in merchant services easier than ever before. Agents, ISOs, Banks, Associations, and Payment Processors are welcoming a new phase of growth and development into their organizations, with Fee Navigator at their side, especially with our API availability and integrations with CRMs.

This new technology will be activated on January 11, 2021. Visit our website to learn more, or watch below our one-minute video sneak peek.