A recent article in Reuters detailed how a small business was charged hundreds of dollars a month in unexpected fees from their payment processing company. This news story reinforces why it’s so important for small and large businesses to read the fine print in their payment agreements.

If you don’t read the fine print with your payment processing services, it could also end up costing your business hundreds of dollars a month.

What is a payment processor?

Payment processors take on the risk for small businesses when a refund is needed for a bad charge. They compile credit and debit card transaction information with the purpose of sending it to banks for payment processing.

As part of this job, some of the risk regarding business owners’ ability to cover refunds for bad charges is placed on payment processors. According to The Nilson Report, processors were paid $20 billion in 2018 for their work.

In the case with the Reuters article, the payment processing company was charging additional fees and markups without the business allegedly knowing it. But had these businesses read the small print, they might have caught the possibility of additional charges before they signed the initial agreement.

A Closer Look at Legitimate Types of Fees

There are two types of fees that are typically associated with agreements between payment processing companies and business owners:

- A fee for its own service. Essentially this is the fee that owners pay directly to the company that handles payment processing.

- Charges that are collected and passed on to networks and issuers such as Visa and Mastercard.

The Hidden Fees You only See in the Fine Print

However, most people don’t see a third fee that some companies charge. This fee is often located in the fine print that can show up on billing statements. This charge is a markup to the card network and issuer charges.

Sometimes the normal company charges and markups are co-mingled into the same billing statement, making it more difficult to see the hidden charge.

According to an article in Reuters, about 200,000 merchants claimed that they were overcharged for various fees and markups by a company. In all of these cases, the fees were included in the fine print of billing statements.

What does this mean for your business?

Regulating the sales practices of the payment processing industry are part of the Federal Trade Commission’s domain. Whether you own your own business or are thinking of starting one, finding the payment processor that works best for you is an important part of saving money.

Different companies offer different plans. Some separately disclose costs, fees, and markups in the original statements to business owners, and others offer a flat rate that includes all charges.

Reading the fine print in the agreement with some payment processors as well as billing statements can save up to 1.95 percent for the types of transactions that qualify as additional fees.

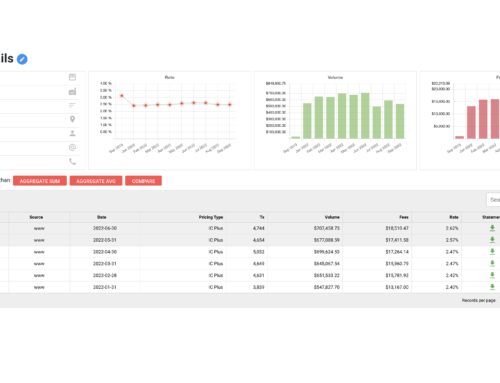

Fee Navigator can help your business by analyzing merchant statements in seconds to make sure you aren’t being charged with any hidden fees.